The value of shares representing ownership in the Green Bay Packers franchise is a crucial component of the team's financial health and overall market standing. This value reflects the market's assessment of the team's future prospects, encompassing factors like current performance, team stability, stadium condition, and fan support. It's determined by supply and demand in the stock market and is influenced by factors such as the team's recent success and the broader economic climate.

Understanding this financial metric is vital for various stakeholders. For investors, it signifies potential returns and risk assessment. For the team's management, it provides insight into the market's perception of their operations and strategic choices. The historical trend of this figure has revealed periods of growth linked to successful seasons and periods of decline during struggles. The influence of these fluctuations on potential investment opportunities is significant. A team's stock value is not solely determined by athletic performance; it also reflects the club's management practices, financial decisions, and commitment to long-term stability.

This article will delve into the factors driving changes in the Packers' financial standing, exploring in-depth the financial implications for the club and its stakeholders. We will also assess how this reflects the team's standing in the NFL landscape and how its performance impacts the broader sports and financial markets. Furthermore, we will discuss the unique aspects of the Packers' ownership structure and how that affects the team's stock valuation compared to other professional sports organizations.

Green Bay Packers Stock Value

Assessing the Green Bay Packers' stock value necessitates a multifaceted approach. This value is a reflection of numerous interconnected factors affecting the team's financial standing and market perception.

- Performance

- Fan base

- Stadium

- Management

- Financial health

- Market trends

- Ownership structure

- NFL landscape

The Packers' stock value, like any publicly traded entity, is contingent upon numerous factors. Performance on the field directly influences investor confidence and thus, the value. A strong fan base translates to higher revenue and a more attractive market position. Modernized stadium facilities can boost the team's value, reflecting its appeal to fans and potential revenue. Effective management plays a crucial role in maintaining financial stability and attracting investments. Strong financial health attracts investors, demonstrating stability and growth potential. General market trends, including economic conditions, impact the team's valuation. The Packers' unique ownership structure affects how the team's value differs from other franchises. Their position within the broader NFL landscape also plays a part, considering their reputation and historical performance against their competitors. All these components work together to create the overall picture of the Packers' stock value.

1. Performance

The Green Bay Packers' on-field performance is a critical determinant of stock value. A consistent string of victories and high-level play fosters investor confidence and drives up the perceived value of the team's stock. Conversely, poor performance, particularly prolonged struggles, can negatively impact investor sentiment and thus, the stock's market value. Strong performances demonstrate a team's ability to attract fans, generate revenue, and maintain a positive public image, all factors crucial for financial success and investor appeal. This connection is not simply correlational; successful play often directly correlates to revenue from ticket sales, merchandise, and sponsorship deals.

Consider the impact of recent Super Bowl appearances or playoff runs on the Packers' stock value. Such achievements demonstrably boost the team's perceived attractiveness, directly influencing the market's valuation of shares. Similarly, sustained periods of poor performance, resulting in lower fan engagement and reduced revenue, have a predictable negative impact on the stock's value. Historical data reveals a clear correlation between the team's on-field success and the trend of the stock's market value. For example, a successful season in 2022 might lead to a rise in the stock's value compared to a lackluster one in 2023. Understanding this interplay is vital for evaluating investment potential and assessing the financial health of the team.

In conclusion, the Packers' on-field performance holds significant weight in influencing stock value. A team's success, or lack thereof, translates directly into investor confidence and the overall financial standing of the organization. This understanding is crucial for assessing the team's financial position and potential for future returns on investment, making the connection between performance and stock value one of the most important metrics for evaluating the Green Bay Packers and similar professional sports organizations.

2. Fan Base

The Green Bay Packers' fan base is a significant factor influencing the team's stock value. A robust and passionate fan base translates directly into revenue streams. Increased attendance at games directly correlates to ticket sales, a major revenue source for professional sports franchises. Merchandise sales, another crucial component of revenue, are closely tied to fan loyalty and enthusiasm. Strong fan support often translates into higher demand for team merchandise, creating a positive feedback loop that further drives the team's financial success and thus, the perceived value of the stock. Historical data consistently demonstrates a strong correlation between fan engagement and the team's financial performance. A loyal fan base fosters a positive brand image, drawing investment and further solidifying the team's market position.

The impact extends beyond direct revenue. A large, engaged fan base signifies a strong community connection and positive brand recognition. This attracts potential sponsors, increasing revenue streams and further strengthening the financial position of the organization, all of which, in turn, contributes positively to the stock's perceived value. Conversely, dwindling fan interest can lead to decreased attendance, lower merchandise sales, and diminished revenue streams, ultimately impacting the team's financial standing and consequently the stock's market value. The unique and devoted nature of the Packers' fan base represents a key part of their inherent value. For example, the sustained fan loyalty throughout challenging periods demonstrates an invaluable asset for maintaining stock value and team stability.

Understanding the connection between fan base and stock value is critical for stakeholders. Investors considering the Packers' stock must assess not just the team's on-field performance but also the strength and engagement of the fan base. Management should prioritize cultivating and maintaining a loyal fan base as a cornerstone of the team's long-term financial health and market success. Maintaining a positive relationship with fans is paramount in attracting and retaining investment and maintaining the intrinsic value of the franchise. A declining fan base can serve as a warning sign to the organization about potential financial challenges, requiring proactive measures to re-engage the fanbase. Consequently, a strong, engaged fan base is not just a desirable characteristic but a vital component for maintaining and increasing the Green Bay Packers' stock value.

3. Stadium

The condition and perceived quality of the Green Bay Packers' stadium significantly influence the team's stock value. A modern, well-maintained facility directly impacts fan experience, revenue generation, and the overall image of the organization. This, in turn, affects the market's perception of the team's worth, reflected in the stock price.

- Facility Modernization and Upgrades

Modernizations and upgrades to the stadium infrastructure often correlate with a rise in stock value. Improved amenities, seating, and technology enhancements contribute to a more attractive fan experience, encouraging increased attendance and boosting revenue. Examples include upgrades to concourse areas, improved sound and visual systems, and enhanced accessibility features. These improvements directly increase revenue potential through ticket sales, concession stands, and merchandise. A modern facility reflects a commitment to the team's long-term success, signaling to investors a willingness to invest in the franchise's future. This boosts investor confidence, consequently positively influencing the stock's valuation.

- Stadium Condition and Maintenance

Conversely, a stadium in disrepair or exhibiting signs of neglect can negatively impact stock value. Substandard facilities detract from the fan experience, leading to lower attendance and potentially jeopardizing revenue. Poor upkeep can signal to investors a lack of commitment to maintaining the franchise's long-term viability, potentially reducing investor interest. This, in turn, translates to a lower stock valuation. Maintaining the stadium's structural integrity and upkeep reflects a commitment to the organization's financial stability and long-term success. Well-maintained structures signal that the organization is committed to present and future profitability.

- Capacity and Accessibility

The stadium's capacity and accessibility features play a role in determining the franchise's value. A stadium with insufficient capacity might limit the team's ability to maximize revenue during high demand periods. Similarly, limited accessibility options could deter certain demographics of potential fans from attending, thereby impacting revenue potential and market share. A well-planned, modern stadium demonstrates the organizations awareness of market demand and its commitment to a broad appeal, all of which positively impacts investor confidence and stock valuation.

- Fan Experience and Amenities

The overall fan experience offered within the stadium directly impacts the team's stock value. The comfort, safety, and overall enjoyment of fans within the stadium environment directly impact their propensity to attend and return. Enhanced amenities like expanded concessions, more diverse food options, improved restroom facilities, and dedicated family sections all contribute to a positive experience. This positive feedback loop, in turn, drives revenue and maintains a strong and positive image for the franchise, thus impacting the perceived value and consequently, the stock price. A negative fan experience can translate directly into a drop in stock value.

In summary, the stadium is more than just a venue for games; it's a crucial element in determining the Green Bay Packers' stock value. A modern, well-maintained, and fan-friendly stadium directly contributes to the team's financial health and positively impacts the perception of its worth by stakeholders. These factors, taken together, provide a comprehensive view of how the stadium's influence extends beyond the immediate game-day experience to become a critical component of the team's overall financial health and stock value.

4. Management

Effective management is paramount in determining the Green Bay Packers' stock value. Strategic decisions, financial acumen, and leadership directly impact investor confidence and, consequently, the market's valuation of the team's shares. The team's leadership influences the team's overall success, revenue generation, and community image, which are all factors directly impacting stock value.

- Financial Strategy and Stability

Sound financial planning is crucial. Successful management demonstrates a capacity to generate and manage revenue effectively, ensuring the team's financial stability and creating a positive outlook for investors. This includes astute budgeting, prudent use of resources, and the ability to identify and seize profitable opportunities. A track record of responsible financial management instills confidence in investors, leading to a higher stock valuation. Conversely, financial mismanagement or unsustainable practices can erode investor confidence and negatively affect the stock price.

- Team Building and Player Acquisition

Competent management effectively assembles and maintains a competitive roster through sound player acquisition strategies. This includes not only identifying and drafting talented players but also fostering a positive team environment, maximizing player performance, and making informed personnel decisions. Such strategic acquisition fosters winning records and enhances the team's performance, which directly relates to increased fan engagement, media attention, and potentially higher revenues, thus positively influencing the stock value.

- Community Relations and Brand Management

Building and maintaining strong community ties is an important aspect of brand management. This involves fostering positive relationships with local stakeholders and supporting community initiatives. A positive image strengthens the Packers' brand recognition and establishes the organization as a respected community member. This translates to heightened fan loyalty, support, and positive media coverage, all of which positively impact the team's perceived value and, consequently, its stock price.

- Adaptability and Innovation

Adapting to changing market dynamics and embracing innovation are key elements of successful management in the modern sports industry. This includes responding to shifts in fan preferences, evolving technologies, and economic conditions. An organization that readily adapts and innovates demonstrates foresight and a commitment to long-term success. This proactive approach to changing environments enhances the franchise's overall appeal, which, in turn, supports stock value by presenting a future-focused and resilient organization.

In conclusion, the management of the Green Bay Packers significantly influences its stock value. From financial prudence to team development, community engagement, and strategic adaptation, every facet of management impacts the team's financial health and market perception. A strong and effective management team cultivates a positive image, builds a successful organization, and ultimately contributes to a higher stock value. These aspects collectively contribute to a broader evaluation of the organization's overall worth, as reflected in the market's valuation of the team's stock.

5. Financial Health

The Green Bay Packers' financial health is inextricably linked to its stock value. A financially sound organization projects stability and growth potential, attracting investors and consequently driving up the stock price. Conversely, financial instability can deter investors, leading to a decline in stock value. This connection is fundamental to understanding the Packers' overall market position and investment appeal.

Robust financial health demonstrates the team's ability to generate consistent revenue, manage expenses effectively, and maintain a healthy balance sheet. This encompasses a wide range of factors, including revenue streams from ticket sales, merchandise, sponsorships, and potentially investments. The efficient management of these resources reflects the team's operational effectiveness and commitment to long-term success, characteristics that investors seek in financially sound companies. For example, consistent profitability over a period will demonstrate this stability and contribute to a positive perception of the stock's future performance, encouraging more investors. Conversely, recurring financial losses or unsustainable debt levels can drastically lower the stock's perceived value, as investors will be wary of such instability.

Understanding this connection is crucial for various stakeholders. For potential investors, it provides a critical metric for evaluating the risks and returns associated with investing in the Packers' stock. For the team's management, it underscores the importance of sound financial strategies and operational efficiency. Moreover, a strong financial foundation directly supports the team's ability to make strategic investments in areas such as player acquisitions, stadium upgrades, and team infrastructure, all of which impact the long-term performance and attractiveness of the franchise, therefore directly influencing stock value. Poor financial health can, conversely, limit the team's ability to respond effectively to market demands and competitive pressures, affecting the value of the franchise. A strong financial foundation not only supports current operations but fosters the long-term sustainability of the organization.

6. Market Trends

Market trends exert a significant influence on the Green Bay Packers' stock value. These trends encompass various economic factors, impacting investor sentiment and, consequently, the price of the team's stock. Understanding these trends is crucial for evaluating the team's financial health and potential investment opportunities.

- Economic Conditions

General economic conditions play a pivotal role. During periods of economic prosperity, investor confidence tends to be high, leading to increased demand for investments, including sports franchises. Conversely, during economic downturns, investors may be more cautious, potentially impacting demand for and thus the price of the team's shares. Recessions, inflation, and interest rate adjustments can all affect the perceived risk and return associated with owning stock in the Packers, causing fluctuations in the team's stock valuation. For example, a robust economy in 2025 might see a surge in the Packers' stock value, while an economic downturn in 2026 could lead to a decrease.

- Interest Rates

Interest rates directly affect the cost of borrowing for the team, which, in turn, affects its investment decisions and profitability. Higher interest rates might increase the cost of financing for any expansion plans, stadium upgrades, or player acquisitions, potentially impacting the perceived attractiveness of the franchise to investors, leading to lower stock valuations. Lower rates might have the opposite effect, as borrowing costs decrease, presenting opportunities and thereby potentially influencing the stock price upward.

- Overall Market Sentiment

Broad market sentiment and investor confidence are major factors. General pessimism or uncertainty in the stock market can negatively affect investor appetite for sports franchise investments, including the Packers. Conversely, a positive and optimistic market environment can lead to increased demand for such investments. Public perception of the team's overall performance, financial health, and leadership plays a significant role in shaping market sentiment, impacting the valuation of the team's stock.

- NFL Performance and Trends

Trends within the NFL have a substantial impact. A general increase or decrease in the perceived value or demand of professional football teams affects the Packers' perceived value relative to other teams, consequently influencing the team's stock valuation. For instance, if there's a general rise in the value of NFL franchises across the league, it might elevate the Packers' stock price; conversely, a downturn could have the opposite effect. Major changes in NFL rules or strategies could also affect how investors perceive the risk and rewards associated with owning Packers stock.

In conclusion, market trends significantly influence the Green Bay Packers' stock value. These trends, ranging from broad economic conditions to specific NFL dynamics, all impact the financial attractiveness of the franchise to investors. Therefore, analyzing these market factors is essential for comprehending the volatility and potential fluctuations of the Packers' stock price and for assessing potential investment opportunities.

7. Ownership Structure

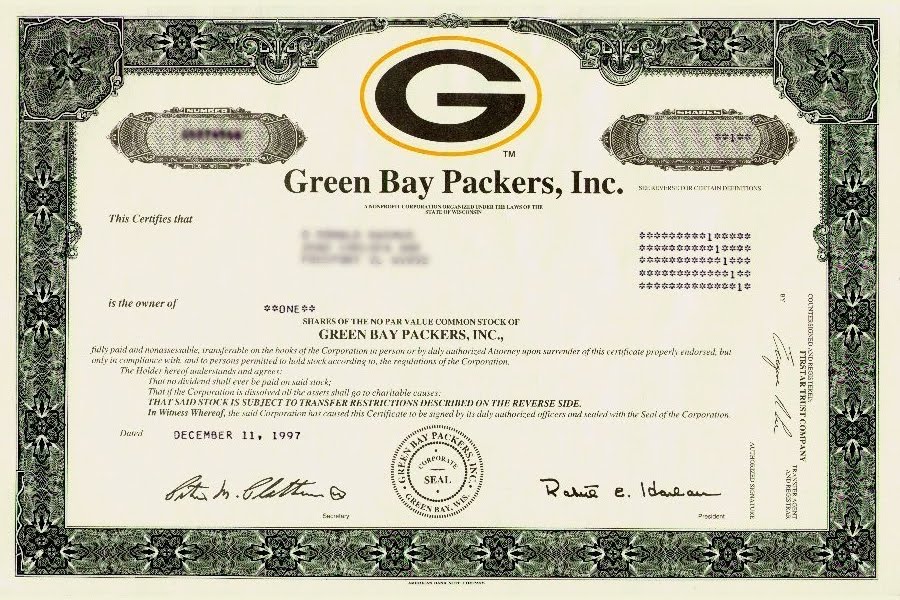

The Green Bay Packers' unique ownership structure significantly impacts the team's stock value. Unlike other NFL franchises, the Packers are owned by fans, through a publicly traded entity. This structure, characterized by a non-profit foundation and employee stock ownership plan, differs markedly from the traditional private or publicly traded corporate models common in professional sports. This unique arrangement has consequences for the stock's market behavior, compared to other NFL franchises, and reflects the organization's commitment to community ownership. The structure fundamentally alters how the team's value is perceived and analyzed in the marketplace. This distinction necessitates a different valuation approach.

The community ownership model, inherent in the Packers' structure, fosters a deep connection between the team and its fan base, promoting a strong sense of shared ownership and loyalty. This loyalty translates into significant fan engagement, which, in turn, can positively influence revenue streams and the team's overall market perception. It also has financial implications, affecting the team's investment priorities and their ability to make large-scale investments in the organization. The impact of community ownership on stock value is often observed through increased fan engagement, translating to elevated revenue streams and a generally positive image of the team. For example, the enduring support shown by fans during periods of lesser on-field success underscores the strength of this unique model.

The structure also presents challenges in terms of valuation. Analysts need to account for the unique dynamics of community ownership when assessing the stock's worth compared to traditionally structured franchises. The non-profit aspect, for example, might affect the way investors perceive potential returns on investment. Investors need to consider how this unique ownership structure translates into practical value. The inherent value proposition of a non-profit versus a profit-driven model needs careful consideration by analysts. Investors analyzing the Packers' stock must understand how this unique structure translates into financial performance and how it aligns with broader investment strategies.

8. NFL Landscape

The NFL landscape significantly influences the Green Bay Packers' stock value. The overall performance and trends within the league impact the Packers' perceived competitiveness and profitability. A strong, healthy NFL fosters higher demand for NFL teams in general, increasing the perceived value of all franchises, including the Packers. Conversely, a struggling or stagnating league can decrease investor interest and, consequently, reduce stock values for all teams, including the Packers. This interconnectedness stems from the NFL's role as a major professional sports league, impacting factors like media coverage, fan engagement, and overall market perception.

Specific league-wide trends, such as emerging powerhouse teams or changes in player contracts, can significantly affect the Packers' valuation. If a new team consistently achieves exceptional results, surpassing established competitors like the Packers, it can potentially diminish the perceived value of the Packers' stock as investors reassess investment opportunities. Conversely, if the NFL experiences a downturn in viewership or significant media scrutiny, this could negatively impact the Packers' stock value as investors may perceive a reduced revenue potential. The Packers' standing relative to the league's overall performance is a vital consideration for investors.

Understanding the NFL landscape's influence on the Packers' stock value is crucial for stakeholders. Investors need to consider the broader context of NFL performance and trends when evaluating the Packers' stock. Management must consider how league-wide trends might impact the team's strategies. The Packers' ability to adapt to evolving league dynamics and maintain a competitive edge within the NFL is directly correlated to the potential longevity and value of the franchise. This understanding is essential for informed investment decisions and long-term planning for the team and its stakeholders. Examples of significant NFL events affecting a team's stock value can be found in league-wide contract negotiations, rule changes impacting team strategies, or significant shifts in fan engagement with the sport. Thorough analysis of these league dynamics is vital for anticipating and adjusting to market fluctuations.

Frequently Asked Questions about Green Bay Packers Stock Value

This section addresses common inquiries regarding the Green Bay Packers' stock value. The following questions and answers offer a comprehensive overview of key factors influencing the team's financial standing and market perception.

Question 1: What factors primarily determine the Green Bay Packers' stock value?

The value of Packers stock is a complex interplay of various factors. Field performance, fan engagement, stadium condition, management effectiveness, overall financial health, prevailing market trends, and the broader NFL landscape all contribute to the team's market valuation. Success on the field, for example, often correlates positively with increased fan engagement and revenue generation, positively impacting the stock price.

Question 2: How does the team's performance on the field affect the stock value?

Strong on-field performance generally translates to higher stock value. Winning records and playoff appearances often attract investors, leading to increased demand for shares and a corresponding rise in the stock's market price. Conversely, consistent poor performance can negatively impact the stock's value, leading to reduced investor confidence and diminished demand.

Question 3: What role does the fan base play in determining the stock value?

A dedicated and engaged fan base is a significant driver of the Packers' stock value. High attendance, merchandise sales, and overall fan enthusiasm contribute to revenue streams and a positive brand image. This, in turn, attracts investors and influences the stock's market price.

Question 4: How does the stadium's condition affect the team's stock value?

A modern, well-maintained stadium contributes to a positive fan experience and increased revenue potential. This translates into a more attractive proposition for investors, leading to a potentially higher stock value. Conversely, a dilapidated stadium can negatively affect investor sentiment and the stock's price.

Question 5: What is the significance of the Packers' unique ownership structure?

The Packers' unique ownership model, characterized by fan ownership and a non-profit foundation, presents distinct factors for valuation analysis. This structure, while unique in professional sports, warrants careful consideration for potential investors to fully grasp the potential implications and risks associated with this type of ownership.

Question 6: How do market trends and the broader NFL landscape affect the Packers' stock value?

General market trends, including economic conditions and interest rates, directly influence investor confidence and the demand for investments, including NFL franchises. Furthermore, the overall performance and trends within the NFL impact the Packers' relative standing and, consequently, their stock valuation. The Packers' market position within the NFL landscape is therefore a crucial factor for evaluating potential investments.

Understanding these factors offers a more comprehensive insight into the intricate dynamics surrounding the Green Bay Packers' stock value.

The next section will explore specific historical data and trends in the Green Bay Packers' stock value over time.

Tips for Evaluating Green Bay Packers Stock Value

Evaluating the Green Bay Packers' stock value necessitates a thorough understanding of various factors influencing market perception. This section provides practical advice for assessing the stock's potential and associated risks.

Tip 1: Analyze Recent Performance Metrics. Scrutinize the team's recent performance on the field. Consistent success, measured by winning records, playoff appearances, and Super Bowl victories, often correlates with increased investor confidence and stock price appreciation. Conversely, prolonged periods of poor performance can negatively impact the stock's valuation. Consider not just the final outcome but also factors like points differential, key player performance, and coaching effectiveness.

Tip 2: Assess the Strength of the Fan Base. The team's fan base is a significant revenue driver. High attendance rates, merchandise sales, and social media engagement are indicators of fan loyalty and enthusiasm. A robust fan base reflects a strong community connection and positive brand image, potentially attracting investors.

Tip 3: Evaluate Stadium Condition and Amenities. A modern and well-maintained stadium enhances the fan experience and contributes to revenue streams. Consider factors like seating capacity, concessions, and overall facility amenities. A dated or poorly maintained stadium could signal a lack of investment and potentially lower the stock's value.

Tip 4: Analyze Management Strategies and Financial Health. Effective management demonstrates financial stability and sound strategic planning. Examine the team's financial statements for consistent profitability, debt levels, and investment in player acquisition and facility upgrades. This helps assess the organization's ability to generate revenue and manage expenses.

Tip 5: Consider Market Trends and the NFL Landscape. General market conditions, interest rates, and broader economic trends impact investor sentiment. Assess the NFL's overall performance and the Packers' competitive position within the league. Changes in the NFL landscape, such as rule alterations or new team successes, influence perceptions of the Packers' future prospects.

Tip 6: Understand the Ownership Structure. The Packers' unique ownership structure differs from other NFL teams. This necessitates a deeper understanding of the potential implications of the non-profit foundation and employee stock ownership plan on financial performance and stock valuation.

Applying these tips provides a framework for evaluating the Green Bay Packers' stock value. A comprehensive analysis incorporating multiple factors offers a more nuanced perspective and allows for a more informed investment decision. Accurate evaluation of the stock's potential depends on thorough research and critical assessment of the contributing elements.

Further analysis of historical data, comparative valuations, and expert opinions on the Packers can provide additional insight into the stock's potential future performance. Crucially, careful consideration of risk factors alongside potential benefits is essential for successful investments.

Conclusion

The Green Bay Packers' stock value reflects a complex interplay of factors. Field performance, fan engagement, stadium conditions, management effectiveness, financial health, market trends, and the broader NFL landscape all significantly influence the perceived worth of the franchise. Strong on-field success, coupled with a loyal and engaged fan base, typically leads to increased investor confidence and higher stock valuations. Conversely, prolonged periods of poor performance or financial instability can negatively impact the stock's market price. The unique ownership structure of the Packers, based on community ownership, introduces distinct considerations for investors, compared to traditional corporate models in professional sports. Understanding these interconnected elements is vital for evaluating the stock's potential and associated risks.

Ultimately, the Green Bay Packers' stock value serves as a tangible reflection of the team's overall health and market standing within the NFL. A comprehensive analysis of these multifaceted factorsfrom on-field performance to the evolving economic landscapeis critical for potential investors seeking to understand the nuances of this investment. The team's future performance, sustained fan support, and consistent financial health will all contribute to the long-term trajectory of the stock's value. Careful consideration of these factors remains crucial for informed decision-making regarding investments in the Packers' stock.