A bank branch is a physical location of a financial institution. It provides a point of contact for customers to conduct various transactions. These transactions can include depositing and withdrawing money, opening and closing accounts, requesting loans, and making payments. A branch's staff facilitates these services and provides support to customers.

Branch locations are a vital component of the banking system, offering tangible access to financial services. They are particularly important for customers who may prefer in-person interactions or require immediate assistance. Branches can play a significant role in community engagement and economic development. The physical presence of a branch often builds trust and fosters a relationship between customer and financial institution, essential in building long-term financial security.

Further exploration of bank branches may delve into topics such as branch networks, the evolution of branch operations over time, and the growing influence of digital banking services. These topics will provide a more nuanced understanding of the modern role of a physical branch within the wider financial landscape.

What is My Bank Branch

Understanding a bank branch involves recognizing its multifaceted role in financial services. This includes its physical location, services offered, and the relationship it fosters with clients.

- Physical Location

- Transaction Services

- Customer Support

- Account Management

- Security Measures

- Community Engagement

- Accessibility Options

A bank branch's physical location provides a tangible point of contact, facilitating direct transactions. Transaction services, encompassing deposits, withdrawals, and payments, are fundamental. Customer support ensures clients receive assistance, while account management allows for various account activities. Robust security measures safeguard financial data, and community engagement fosters trust. Accessibility options cater to diverse needs. For instance, a branch's location in a high-traffic area highlights its accessibility, while its ATMs or online banking portals further enhance ease of access, broadening its services. All of these aspects combine to form the multifaceted experience of a bank branch, supporting diverse financial needs.

1. Physical Location

The physical location of a bank branch is intrinsically linked to its function and overall significance. A branch's address defines its accessibility, impacting customer convenience and the institution's reach within a community. Proximity to potential clients is a key determinant in attracting customers and facilitating transactions. A branch situated in a densely populated area, for example, offers increased accessibility, facilitating more interactions and transactions than a branch in a less accessible or populated location. This spatial element, therefore, directly influences the volume of business handled by a particular branch and the institution's broader success.

Furthermore, the physical location of a bank branch implicitly communicates the bank's commitment to a specific community. The presence of a branch in a neighborhood demonstrates a direct investment in that area's economic well-being, often fostering trust and community engagement. The design and layout of the branch itself, reflecting community standards and preferences, can also affect customer perception and satisfaction. A branch's location, therefore, extends beyond mere convenience; it represents a significant aspect of the institution's presence and its commitment to the specific geographic area served.

Understanding the connection between physical location and a bank branch is crucial for both customers and the institution itself. Customers benefit from readily accessible banking services, while the bank benefits from increased foot traffic and community engagement. Strategic placement of branches, considering factors such as population density, transportation networks, and local demographics, is essential for maximizing operational efficiency and achieving business objectives. Analysis of successful branch locations provides valuable insight into these practical considerations and the broader significance of the physical aspect of a bank's presence.

2. Transaction Services

Transaction services are fundamental to the operation of a bank branch. They represent the core functions of a branch, enabling customers to interact with financial assets and undertake crucial financial activities. Understanding these services is key to comprehending the multifaceted role of a bank branch in the financial landscape.

- Deposits and Withdrawals

Depositing and withdrawing funds are essential transactions. Branches facilitate these actions, enabling customers to manage their cash holdings. Examples include depositing payroll checks, making direct deposits, or withdrawing cash from accounts. These services are fundamental for managing daily financial needs and form the cornerstone of a branch's operational structure.

- Payment Processing

Branches process payments of various types, including bill payments, loan repayments, and money transfers. These transactions encompass a wide range of financial activities. Examples include paying utility bills, transferring funds between accounts, or initiating loan payments. Efficient payment processing is crucial for customers' financial management and the overall operational efficiency of the branch.

- Account Management

Account management involves opening, closing, and modifying accounts. Branches provide support for these transactions, enabling customers to establish or modify their financial relationships with the institution. Examples include opening savings accounts, closing checking accounts, or changing account details. This aspect allows customers to tailor accounts to their evolving financial needs and demonstrates the flexibility inherent in a well-functioning branch.

- Loan Services

Branches often handle loan applications, approvals, and disbursals. Customers can apply for various loans through the branch, including mortgages, personal loans, or business loans. This service is instrumental in providing access to capital for financial growth. The efficiency and accessibility of loan services are crucial for the growth and prosperity of customers and the lending institution.

These transaction services are inextricably linked to the function of a bank branch. The branch's capacity to efficiently process these services directly impacts customer satisfaction and the overall success of the financial institution. Effective transaction services are vital for a thriving branch, and their smooth operation underscores the branch's role in facilitating financial transactions for individuals and businesses.

3. Customer Support

Customer support is a crucial component of a bank branch. Its effectiveness directly impacts the overall experience and perception of the institution. Exceptional support fosters customer loyalty, encouraging repeat business and positive referrals. Conversely, inadequate support can lead to dissatisfaction, deterring potential customers and damaging reputation. Efficient handling of customer queries, concerns, and complaints within the framework of a branch is paramount to a bank's success. A well-trained and responsive support staff is essential for addressing issues and concerns quickly and thoroughly.

Real-life examples highlight this connection. A branch with a knowledgeable staff adept at explaining complex financial products can generate high satisfaction among customers. Conversely, a branch experiencing high customer complaint rates due to slow or unhelpful support can erode trust and lead to negative publicity. The efficiency and effectiveness of customer support are demonstrably linked to branch performance and ultimately, the bank's financial health. This is directly observable in customer feedback and retention rates. Prompt and courteous resolutions to customer inquiries, whether in person or through phone, create a positive perception.

Understanding the interplay between customer support and a bank branch is essential for achieving strategic objectives. By prioritizing comprehensive customer support strategies within the operational structure of a branch, banks can improve customer retention, boost their reputation, and drive sustainable growth. Addressing customer concerns promptly and thoroughly builds trust and encourages long-term relationships with clients. Ultimately, the quality of customer support is a direct reflection of the value a bank places on its customers and their overall satisfaction within the branch environment.

4. Account Management

Account management within a bank branch is a critical function directly impacting the overall efficacy of the institution. It encompasses the various processes and procedures associated with establishing, maintaining, and modifying customer accounts. Effective account management within a branch ensures streamlined transactions and customer satisfaction, ultimately reflecting favorably on the bank's reputation.

- Account Opening and Closure Procedures

Standardized processes for account opening and closure are essential for maintaining consistency and efficiency. Clear guidelines and readily available documentation facilitate these procedures, ensuring compliance with regulations. Well-defined steps within the branch streamline the process, minimizing delays and potential errors. Examples include verifying identification, completing required forms, and adhering to the bank's specific account opening criteria.

- Account Maintenance and Updates

Regular account maintenance involves updating customer information, adjusting account settings, and managing transaction history. This ensures the accuracy of records and the seamless processing of transactions. Maintaining accurate customer details, such as address or contact information, ensures the security and efficiency of account management. Up-to-date account information allows for timely adjustments to account features, reflecting changes in a customer's financial circumstances.

- Security and Compliance Procedures

Security is paramount in account management within a bank branch. Implementing and enforcing strict security protocols, including verification procedures and adherence to regulations, ensures the protection of customer funds and data. This includes safeguarding sensitive account information from unauthorized access and implementing measures for fraud prevention. Compliance with all applicable financial regulations, including KYC (Know Your Customer) procedures, is vital for maintaining a trustworthy operational framework.

- Customer Service and Support

Responsive customer service plays a crucial role. A well-trained staff equipped to address queries and resolve issues effectively is essential. This includes clear communication regarding account status, transaction history, and resolving discrepancies promptly and professionally. Adequate support ensures customer satisfaction, fostering a positive relationship between customer and institution.

Effective account management, therefore, is integral to the operational efficiency of a bank branch. By streamlining procedures, ensuring security, and providing excellent customer service, a branch maximizes its contributions to customer satisfaction and the overall success of the institution. Well-managed accounts translate into a strong reputation for reliability and service, fostering both customer loyalty and attracting new clients.

5. Security Measures

Security measures are paramount to the function of a bank branch. Protecting customer assets and sensitive information is critical for maintaining trust and operational integrity. The physical environment and internal procedures within a branch directly affect the security of transactions and information, underscoring the importance of robust security protocols.

- Physical Security Protocols

Physical security measures encompass the tangible safeguards implemented within the branch's environment. These include security cameras, access control systems, alarm systems, and strategically placed security personnel. Robust security features, such as reinforced doors and surveillance equipment, deter potential intruders and safeguard valuable assets. Modern security systems often incorporate biometric access control for added protection and contribute to the safe operational environment of the branch.

- Transaction Security Measures

Protecting transactions is crucial. This encompasses secure handling of cash, implementing strong authentication procedures for online and in-person transactions, and adhering to established protocols for handling sensitive financial documents. Procedures like secure deposit boxes, encrypted financial communications, and multi-factor authentication ensure the integrity and safety of all transactions within the branch. The implementation of these procedures underscores a commitment to financial security for all involved.

- Data Security Protocols

Protecting customer data is vital. This involves secure storage of customer information, adhering to data encryption standards, and implementing strict access controls to prevent unauthorized access. Strong encryption protocols, firewalls, and regular security audits are crucial elements of this aspect. The secure handling of sensitive data and adherence to stringent data privacy regulations build customer trust and reinforce the operational integrity of the institution.

- Employee Training and Policies

Employee training is essential to security. Effective training programs equip staff with the knowledge and skills to identify and respond to potential security threats. Comprehensive policies regarding handling cash, safeguarding information, and reporting suspicious activities are critical to maintaining a secure environment. Effective employee training, combined with clear policies, directly contributes to the overall security posture of the branch and the institution as a whole.

The multifaceted approach to security within a bank branch directly influences the institution's reputation and customer trust. Robust security measures not only protect assets but also contribute to a positive customer experience. A commitment to security fosters a safe and reliable environment, promoting customer confidence and the overall health of the financial institution.

6. Community Engagement

Community engagement represents a significant aspect of a bank branch's role beyond simply providing financial services. It reflects the institution's connection to the surrounding area and its commitment to local economic well-being. This engagement can manifest in various forms, impacting the branch's reputation, customer relations, and overall success. A deep understanding of this connection is crucial for both the bank and the community it serves.

- Local Partnerships and Sponsorships

Collaborations with community organizations, schools, and non-profits demonstrate a bank's commitment to local development. Sponsorship of local events, participation in fundraising drives, and support for community initiatives foster positive public relations. This active involvement positions the branch as a responsible corporate citizen, contributing to the local economy and strengthening relationships with residents. For example, a branch's sponsorship of a youth sports program or an arts festival can greatly enhance their positive image within the community.

- Job Creation and Economic Development

The presence of a bank branch in a community often leads to job creation, directly impacting local employment rates. The branch itself employs local residents, and associated business development initiatives can create further opportunities. For instance, a bank's support for local entrepreneurs through small business loans or financial literacy programs can stimulate economic growth within the area. This aspect directly links the branch's operations to the community's economic prosperity.

- Financial Literacy Initiatives

Financial education programs offered by the branch promote financial well-being within the community. Workshops, seminars, and educational materials targeted at specific demographics can empower individuals to make informed financial decisions. This proactive engagement enhances the bank's reputation and demonstrates a commitment to long-term community growth. For example, workshops for low-income families on budgeting and savings can have a substantial positive impact on the financial health of the community.

- Accessibility and Inclusivity

A branch's commitment to accessibility reflects a broader concern for the needs of the entire community. Accessibility features in the branch design, language support for diverse communities, and flexible service hours demonstrate responsiveness to local needs. This thoughtful consideration strengthens the bank's reputation and enhances its relationship with a broader range of residents within the community.

In conclusion, community engagement is not merely a desirable characteristic but a fundamental aspect of a bank branch's successful operation. A branch deeply rooted in the community fosters trust, strengthens relationships, and contributes to a more prosperous environment. These efforts are intrinsically linked to the long-term success of the bank, its reputation, and the overall economic well-being of the area it serves.

7. Accessibility Options

Accessibility options are integral components of a bank branch's operational effectiveness. The design and services offered must consider the diverse needs of the community served. Meeting these needs fosters a wider range of customer interactions and overall success for the financial institution. The presence of appropriate accessibility options is not simply a matter of compliance, but a strategic decision impacting customer satisfaction, community engagement, and the institution's reputation. Failing to provide these options can lead to decreased customer base and hindered community outreach, illustrating a direct cause-and-effect relationship between accessibility and branch performance.

Examples of practical accessibility options include accessible entrances and pathways, ramps for wheelchair users, and readily available assistive technologies. Clear signage in multiple languages, audio-visual tools for visually impaired customers, and designated areas for mobility assistance further enhance inclusivity. The availability of ATM machines with tactile interfaces, or branches staffed with employees trained to assist customers with disabilities are also crucial components. Consideration for individuals with varying needs, including those who may have language barriers, cognitive impairments, or temporary disabilities, demonstrates a proactive approach to customer service. Such provisions not only cater to specific needs but also enhance the overall perception of the branch as a trustworthy and community-focused institution.

Understanding the importance of accessibility options within the context of a bank branch highlights the significant link between inclusivity and success. A well-designed and accessible branch effectively caters to a broader customer base, reflecting favorably on the institution's reputation and community engagement. This fosters trust and loyalty, ultimately benefiting the institution's financial well-being. The practical implications extend beyond compliance; a well-designed accessibility plan is a valuable marketing tool, attracting a larger clientele and reinforcing a commitment to inclusivity and community engagement. Failure to address accessibility issues can result in a decreased customer base, limiting the branch's potential reach and impact.

Frequently Asked Questions about Bank Branches

This section addresses common inquiries regarding bank branches, providing clear and concise answers to help customers better understand the services and operations of these financial institutions.

Question 1: What is the purpose of a bank branch?

A bank branch serves as a physical location for customers to conduct various financial transactions. These include depositing and withdrawing funds, opening and managing accounts, applying for loans, and making payments. Branches provide a point of contact for personal interactions and immediate assistance.

Question 2: How can I find my nearest bank branch?

Locate a bank branch through the institution's website. Many banks provide online branch locators with interactive maps, enabling users to search for branches based on location, address, or zip code. Alternative methods include using a search engine to search for the nearest branch of the specific bank.

Question 3: What services are typically offered at a bank branch?

Common services include account management (opening, closing, modifying accounts), transaction processing (deposits, withdrawals, payments), loan applications, and customer support. Some branches may also offer specialized services such as foreign exchange or financial planning.

Question 4: Are bank branches still important in the digital age?

Despite the growth of online and mobile banking, bank branches remain significant. They offer an alternative for in-person transactions and support for customers who prefer face-to-face interaction, particularly for complex issues or sensitive matters. Branches can also facilitate community engagement and economic development.

Question 5: What security measures are in place at bank branches?

Bank branches employ various security measures, including surveillance systems, access controls, and trained security personnel. These precautions are designed to protect both customer assets and the physical facility, aiming to prevent theft and fraud. Strong authentication procedures are also implemented.

Question 6: How do I contact a bank branch if I have questions?

Contact details are typically available on the bank's website or within the branch's location information. These include phone numbers, physical address, or email addresses for inquiries.

Understanding the multifaceted role of a bank branch and its various services is crucial for effectively managing personal finances and utilizing financial institutions efficiently. This FAQ section should be considered a helpful starting point for customers needing answers and clarity. Additional financial information is often available through the bank's website and client portals.

This concludes the frequently asked questions regarding bank branches. The next section explores the historical context of bank branches.

Tips for Utilizing Bank Branches Effectively

This section offers practical guidance for maximizing the benefits of bank branches. Understanding procedures and utilizing services efficiently can lead to a more positive and effective banking experience.

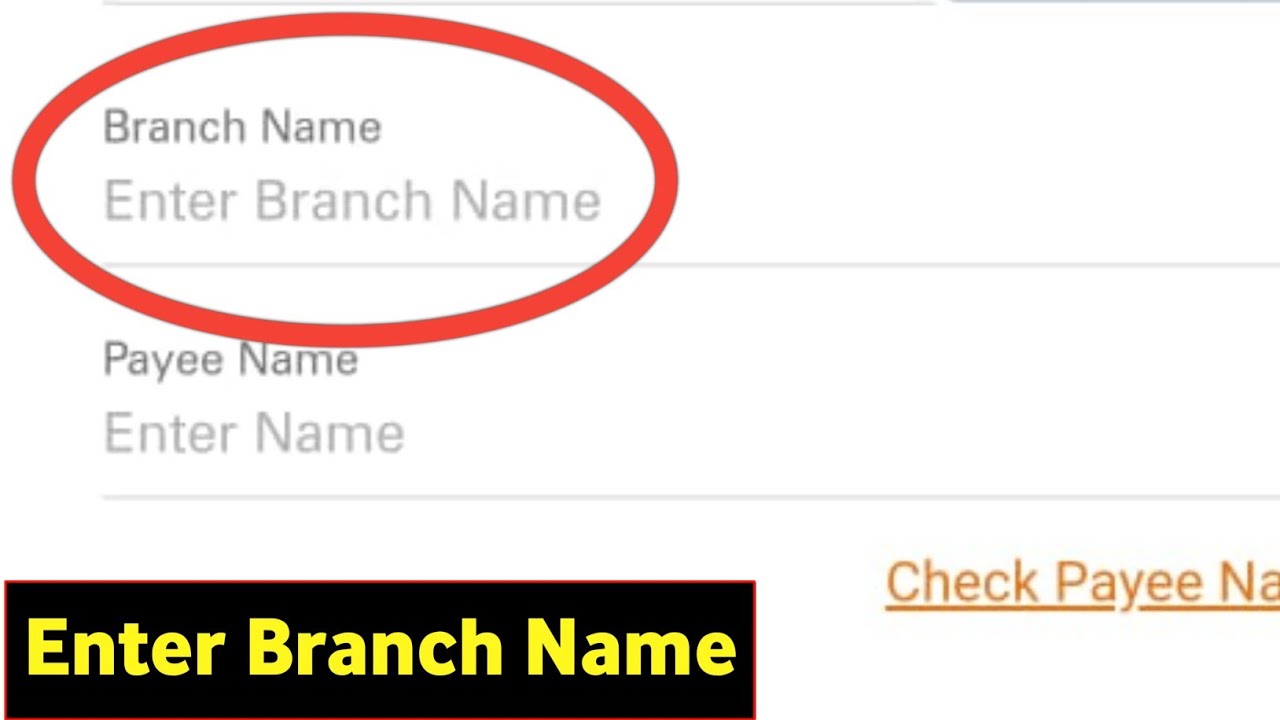

Tip 1: Thorough Research Prior to Visiting. Before visiting a bank branch, research the specific services offered. Review the bank's website or app to understand hours of operation, available loan types, or specific account details. This preparedness minimizes wait times and ensures a focused interaction with staff.

Tip 2: Plan Transactions in Advance. Pre-planning transactions, such as deposits or withdrawals, can significantly reduce wait times. Preparing necessary documentation and organizing financial records beforehand ensures a smoother interaction and avoids delays during the visit. Gathering account numbers and transaction details can save time at the branch.

Tip 3: Utilize Online Tools. Many banks offer online tools or mobile apps for account access, fund transfers, and bill payments. Utilize these options whenever possible to complete routine tasks and minimize visits to the physical branch. Online banking reduces branch congestion and simplifies routine transactions.

Tip 4: Seek Assistance for Complex Issues. If encountering complex financial concerns or issues that require intricate solutions, prioritize in-person consultation at a branch. Bank staff possesses specialized knowledge and can provide personalized support that online platforms might not offer. The expertise of branch staff is often beneficial for resolving intricate financial matters.

Tip 5: Maintain Accurate Records. Maintaining accurate records of transactions, account information, and important dates is crucial. This facilitates efficient and smooth interactions during branch visits. Clear documentation minimizes errors and avoids discrepancies, enhancing the efficiency of service delivery.

Tip 6: Understand Fees and Charges. Familiarize yourself with fees and charges associated with various services and account types. Understanding these aspects beforehand avoids surprises and ensures informed decision-making. Researching associated fees streamlines financial decisions and supports better financial management.

Summary: Proactive preparation, effective utilization of online tools, and leveraging branch staff expertise for complex issues are key factors for a positive and effective branch experience. Maintaining clear records and understanding fees further enhance the process.

This section has emphasized practical strategies for navigating bank branches efficiently. Subsequent sections will delve deeper into the historical context and future implications of bank branch operations.

Conclusion

This exploration of bank branches has illuminated their multifaceted role within the financial landscape. From the crucial transaction services offered, such as deposits and withdrawals, to the essential customer support provided, the physical branch remains a vital component. The importance of a physical presence cannot be understated, particularly for complex transactions or in-person assistance. Strategic location, robust security measures, and a commitment to community engagement are also highlighted as vital elements of a successful branch operation. Furthermore, the integration of accessibility options demonstrates a commitment to inclusivity. These various aspects, collectively, underscore the enduring significance of the bank branch in the modern financial world.

The future of bank branches may involve evolving beyond a purely transactional space. Adaptability and innovation will be critical for maintaining relevance. Branches could potentially leverage their physical presence to deliver advanced financial counseling and personalized investment strategies, fostering trust and long-term relationships. By embracing a broader role, bank branches can remain essential components of financial institutions, addressing evolving customer needs and navigating the dynamic landscape of financial services. Understanding the various functions and services offered by bank branches will empower individuals to maximize their banking experience.