The ownership relationship between Ruger and Remington is a significant topic in the firearms industry. Determining if one company controls the other reveals crucial information about market consolidation, competitive pressures, and potential future strategic direction. Understanding this ownership dynamic provides context for analyzing the companies' product development, pricing strategies, and overall positioning within the market.

The potential for a merger or acquisition between firearm manufacturers has substantial implications. Such events can lead to changes in product offerings, manufacturing processes, and potential shifts in market share. The resulting impact on consumer choice and the availability of firearms is a key consideration for policymakers and consumers. Historical precedents of consolidation and divestiture in the firearms industry can be useful in analyzing potential outcomes of such events.

This information is essential for understanding the current landscape and future trajectory of the firearms market. Subsequent analysis will explore the specific details surrounding the companies, including their individual market positions, product lines, and past ownership history, as a prerequisite to understanding the broader implications of potential ownership transitions.

Does Ruger Own Remington?

Determining if Ruger owns Remington is crucial for understanding the competitive landscape and potential market shifts in the firearms industry. This involves examining the corporate structure, historical acquisitions, and current market positioning of both companies.

- Ownership status

- Company history

- Acquisition records

- Market share analysis

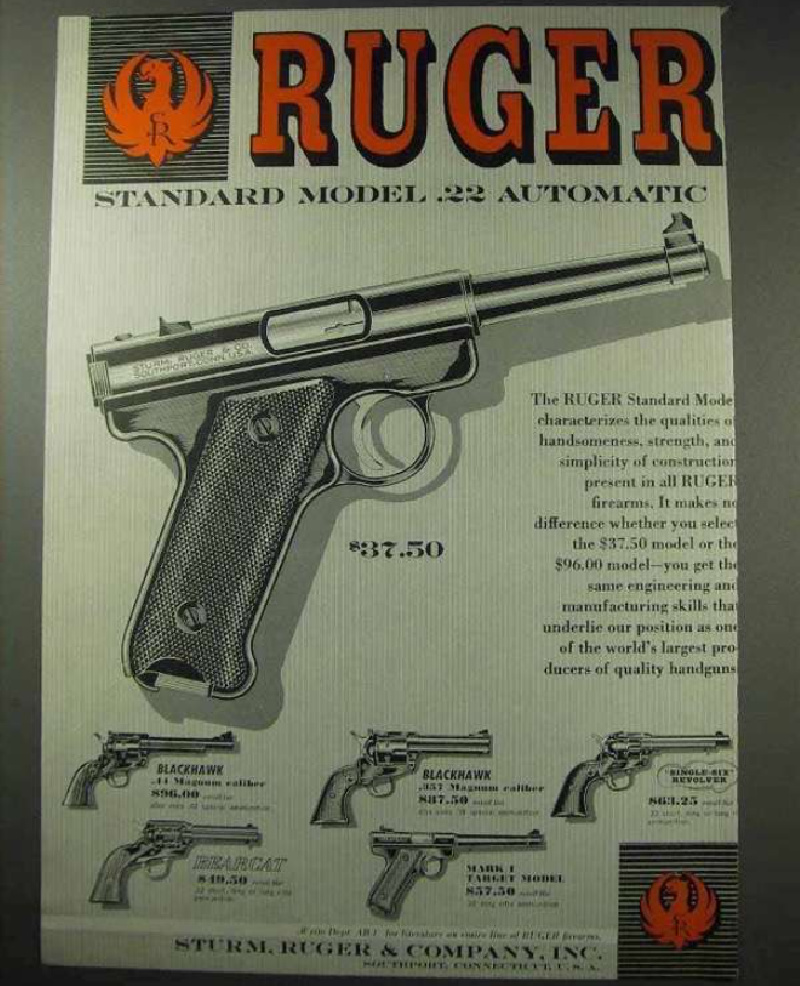

- Product lines

- Financial reports

- Competitive dynamics

- Industry consolidation

Analyzing the ownership structure requires examining historical acquisitions, public statements by company leadership, and reviewing financial reports. Market share analysis helps understand the competitive standing of each manufacturer. Examining product lines reveals potential overlap or diversification. Financial reports offer insight into potential capital expenditures. Industry consolidation trends indicate factors influencing corporate ownership. Careful evaluation of these aspects, drawing connections from company history to current market positions, is vital for understanding the complex interplay between the two firearm manufacturers. For instance, a company known for acquiring others might signal potential for future acquisitions. This overall analysis allows a comprehensive understanding of the current business landscape and future expectations within the firearms sector.

1. Ownership Status

Determining the ownership status of one company by another is a fundamental aspect of understanding market dynamics, especially within industries like firearms manufacturing. Understanding if Ruger owns Remingtonor vice versainvolves analyzing the corporate structure and historical actions of both companies. This is crucial for evaluating market positioning, potential future strategies, and competitive interactions.

- Corporate Structure and Ownership Documents

Reviewing official corporate documents, such as ownership records, is essential. These documents often detail who holds controlling interest or equity in a company. Analyzing these records reveals whether one company has acquired or taken over the other's shares or operations. Examples include articles of incorporation, stock ownership registries, or merger and acquisition agreements.

- Financial Reports and Transactions

Analyzing financial reports, particularly statements regarding mergers, acquisitions, or divestitures, offers direct evidence of ownership changes. Reports detailing significant financial transactions, such as acquisitions or investments, are valuable in assessing the degree of control one entity has over another. Careful examination of transaction details allows for a more accurate assessment of the current ownership status.

- Public Statements and Press Releases

Public pronouncements and press releases by the respective companies offer insights into their relationships. Statements regarding business strategies, partnerships, or acquisitions can confirm or contradict implied ownership scenarios. However, interpreting these requires careful attention to the exact wording and context, acknowledging possible strategic aims that might be obscured by language.

- Market Analysis and Competitive Dynamics

Assessing the market positioning of both companies is vital. Strong evidence of ownership, especially if one company significantly impacts the market share or product offerings of another, would strongly imply a significant level of control. Historical and contemporary market analysis helps evaluate the potential impact of an ownership relationship on market share, pricing, and consumer choices within the firearms industry.

These factors collectively contribute to a comprehensive understanding of ownership status. A thorough examination of these elementscorporate structure, financial transactions, public statements, and market analysisprovides crucial context for evaluating whether Ruger owns Remington and the overall ramifications of such a relationship within the firearm industry.

2. Company History

Examining the historical trajectories of Ruger and Remington is crucial for understanding the potential ownership relationship between the two companies. Company histories provide context for mergers, acquisitions, and market strategies. Patterns of acquisition or divestment, product development strategies, and leadership transitions can all offer clues to the possibility of a direct or indirect ownership link.

- Acquisition History and Patterns

Tracing each company's acquisition history reveals patterns of growth and strategic shifts. Identifying previous acquisitions or mergers can illuminate possible motivations and strategies, including vertical integration or market expansion. If either company has a history of significant acquisitions, that suggests a potential interest in additional acquisitions, perhaps including Remington. Conversely, a history of divestment might indicate a disinterest in controlling another company.

- Leadership and Management Changes

The leadership and management of both companies throughout their history offer insights into corporate cultures and strategic priorities. Shifts in leadership can signal shifts in focus or objectives, potentially indicating an increased interest in mergers or acquisitions. Examining whether key leadership figures at either company have backgrounds in or demonstrated interest in acquiring other firms is significant in evaluating possible ownership relationships.

- Product Development and Market Positioning

Reviewing the evolution of product lines reveals potential overlaps or areas of synergy. If Ruger's product line shows similarities to or overlaps with Remington's, it could suggest potential strategic interest in expanding their product offering or market share through acquisition. A history of competing in the same markets or product lines, coupled with changes in market share, also provides significant evidence that can help understand ownership.

- Financial Performance and Trends

Analyzing financial data, including historical revenue, profitability, and investment patterns, can reveal the financial motivations behind potential acquisitions. Trends in financial performance, such as periods of growth or decline, can suggest changes in corporate strategies that might involve acquiring a competitor to bolster market share or reduce competition.

Understanding the historical context of both companies, considering their acquisition histories, leadership transitions, product development strategies, and financial performance, provides a deeper understanding of the potential connection. While historical information does not definitively answer the question of ownership, it offers valuable clues and enhances the analysis of current market conditions in the firearm industry.

3. Acquisition Records

Acquisition records play a critical role in determining ownership relationships, such as whether Ruger owns Remington. These records document transactions where one company acquires another. Crucially, they provide concrete evidence of control shifts. The absence of such records strongly suggests a lack of ownership. Comprehensive acquisition records are essential to establish the historical chain of ownership, detailing the transfer of assets and liabilities from one entity to another. This documentation is pivotal in verifying the structure of ownership throughout the relevant time period.

Detailed acquisition records are vital for establishing the current ownership structure of a company. They identify the parties involved, the date of the transaction, and the terms of the agreement. Furthermore, these documents, often including legal filings, contracts, and financial statements, are essential in verifying the legitimacy of ownership claims. Analyzing these records provides insight into the reasons behind acquisitions and the potential impact of those transactions on the acquiring and acquired companies. For instance, analyzing acquisition records might reveal that while Ruger has acquired other companies, Remington is not listed among those holdings, which weakens the hypothesis of Ruger's ownership.

Access to and careful analysis of accurate acquisition records is crucial for establishing verifiable ownership. Without them, inferences about ownership remain speculative. The practical significance lies in understanding corporate structure, competitive dynamics, and market valuation. For a definitive answer to the question of Ruger owning Remington, complete and verifiable acquisition records are paramount. If such records do not exist or do not show a transaction, it significantly reduces the probability of Ruger possessing ownership interest in Remington. The understanding derived from these records ultimately shapes the interpretation of market trends and corporate strategy in the firearm industry.

4. Market share analysis

Market share analysis is a critical component in understanding the dynamics of the firearms market and, by extension, the potential implications of ownership changes like a hypothetical acquisition of Remington by Ruger. A significant shift in market share following a potential acquisition would strongly indicate a change in market control. Analyzing historical market share data provides crucial context for assessing the potential impact of a merger or acquisition. If Remington's market share experienced a notable increase after a potential acquisition by Ruger, that would suggest a possible gain in control and market influence.

For instance, if Ruger, after a potential acquisition of Remington, experiences a significant increase in overall firearms sales and market share in specific product categories, it would lend credence to the idea that a consolidation of ownership had a demonstrably positive effect on the acquiring company's market position. Conversely, a decline in market share for either company following a potential acquisition could signal various issues, including integration challenges, a shift in consumer preferences, or issues within the manufacturing and distribution processes following the transaction. Such analysis requires careful consideration of market trends, including changes in consumer preferences, technological advancements, and the emergence of competitors. This helps in isolating the impact of the potential acquisition itself from external market factors.

Understanding market share trends before, during, and after a potential acquisition is essential for stakeholders such as investors, policymakers, and consumers. This analysis can reveal the true effects of a merger or acquisition, distinguishing between improvements or declines attributable solely to the potential takeover and those stemming from broader market forces. A thorough market share analysis can help assess whether such a transaction leads to greater market concentration or, potentially, a more competitive landscape. Ultimately, the importance of market share analysis lies in its ability to provide quantitative evidence of the impact that an ownership change, like a hypothetical acquisition of Remington by Ruger, has on the overall market. This is valuable for informed decision-making across multiple facets of the firearms industry, including investment strategies and regulatory considerations.

5. Product Lines

Analyzing product lines is a key aspect in assessing the potential ownership relationship between Ruger and Remington. Overlapping or complementary product lines might suggest strategic motivations for acquiring one company by the other. Conversely, distinct product lines would suggest less incentive for such a merger or acquisition. This examination considers how the respective product offerings fit into the overall market.

- Product Overlap and Synergy

Identifying similarities between Ruger and Remington's product lines reveals potential areas of synergy. If significant overlap exists in target markets, product design, or manufacturing processes, a potential merger becomes more plausible. For example, if both companies produce firearms with comparable features or target similar consumer segments, a potential acquisition might seek to leverage existing market access and reduce competition in a given sector.

- Complementary Product Lines

Assessing whether product lines complement each other highlights another aspect of a possible acquisition strategy. If Remington offers products that extend Ruger's existing range into new markets or fill gaps in their product portfolio, the acquisition becomes a potentially valuable strategic move. For example, if Ruger primarily produces rifles and Remington specializes in shotguns or handguns, acquiring Remington could diversify Ruger's product line and broaden its market reach.

- Competitive Positioning and Potential Conflicts

Conversely, overlapping products may result in direct competition. Analysis of potential overlap in target markets, product features, and pricing strategies is crucial. If one company's products directly compete with another's, a potential acquisition might be seen as a means to eliminate the competitor, consolidate market share, and potentially reduce costs through combined production. However, such overlaps also create potential internal conflicts and difficulties in integrating existing product lines.

- Diversification and Expansion Strategies

Companies might pursue an acquisition to expand into new markets or product categories. Analyzing Remington's and Ruger's product lines reveals if such a pattern exists. For example, if one company offers products in a market segment that the other lacks, an acquisition might represent a strategy for diversification and potentially enhanced profitability.

In summary, evaluating the connection between product lines and a potential ownership relationship between Ruger and Remington involves a thorough examination of both companies' existing product offerings. Identifying overlaps, complementarities, competitive positioning, and potential expansion strategies offers significant insights into the strategic motivations behind an acquisition, thereby facilitating a comprehensive understanding of potential market shifts within the firearm industry. This detailed analysis contributes to a more robust evaluation of the potential benefits and drawbacks of a merger between the two companies.

6. Financial Reports

Financial reports are crucial for evaluating the potential ownership relationship between Ruger and Remington. These documents provide detailed insights into each company's financial health, including revenue, expenses, assets, and liabilities. By analyzing these reports, one can determine if financial transactions, such as acquisitions, have taken place, shedding light on the degree of control one company might hold over another.

- Acquisition Activity

Analyzing financial reports for evidence of significant acquisition activity is paramount. Look for entries detailing the purchase of another company. This might involve specific entries within the "acquisitions and divestitures" section or within the "assets" category. If Remington's assets or stock appear in Ruger's financial reports in a way that suggests control, it strongly supports the idea of ownership. Conversely, the absence of such activity, or the presence of divestitures, weakens the argument for ownership. Specific financial ratios can be helpful to evaluate whether such an acquisition is beneficial in the long term. Examine transaction details, payment methods, and resulting effects on the balance sheets and income statements of both companies.

- Changes in Financial Structure

Fluctuations in capital structure (debt, equity, and ownership percentages) might indicate a significant ownership shift. If Ruger's financial structure noticeably changes following a supposed period around the time of a potential acquisition of Remington, a deeper dive into the reports is required to assess the extent of the shift. Analyzing changes in asset composition and liability ratios can reveal if a merger or acquisition occurred. A significant increase in assets related to Remington in Ruger's balance sheet, or a change in debt structures, should be investigated carefully.

- Profitability and Market Share

An analysis of the companies' profitability trends, and a comparison of market share data, provides insights into the possible impact of a potential acquisition. If Ruger's profitability or market share displays a notable shift, such changes might be attributed to an acquisition of Remington. A decline in market share in a competitor's products after the potential acquisition suggests a possible rationalization and consolidation of market share that might have occurred due to a merger or takeover.

- Management Discussion and Analysis (MD&A)

The MD&A section of financial reports often provides management's perspective on the company's performance and future prospects. Look for any commentary on strategic initiatives that might involve acquisitions or strategic partnerships. Mention of Remington within this section (or a lack of such mention) is valuable context. This section offers insight into management's strategy regarding its possible acquisition of or involvement with Remington and allows a greater understanding of the motivations, plans, and implications of any such acquisition.

Financial reports, when examined meticulously, offer valuable insights into the ownership relationship between Ruger and Remington. Thorough examination of acquisition activity, changes in financial structure, profitability trends, and the MD&A section allows for a more informed evaluation of the potential acquisition. However, it is essential to recognize that financial reports alone might not provide conclusive evidence and should be considered in conjunction with other relevant data points.

7. Competitive Dynamics

Competitive dynamics within the firearms industry are a crucial component when evaluating potential ownership relationships, such as the hypothetical ownership of Remington by Ruger. Analyzing competitive pressures illuminates strategic motivations behind mergers and acquisitions. A company might seek to acquire a competitor to consolidate market share, eliminate direct competition, or gain access to complementary products or technologies.

The presence of intense competition can heighten the incentive for a company like Ruger to acquire a competitor like Remington. If the market is characterized by low profitability or limited growth opportunities, a merger or acquisition could enhance profitability by reducing costs, streamlining operations, and expanding into new markets. Alternatively, if the competitive landscape exhibits significant product overlap, an acquisition could potentially reduce redundancy, consolidate production, and improve overall operational efficiency. Consider the consolidation of smaller, less competitive firms within the firearms industry. This often reflects a response to greater, more competitive rivals. Historical examples of acquisitions in other industries show how consolidating resources can often yield efficiency gains and greater profitability.

Conversely, a lack of intense competitive pressure might lessen the strategic importance of an acquisition. If market conditions are favorable or if the competitor is not a significant threat, the incentive to acquire diminishes. Competitive dynamics, therefore, play a crucial role in assessing the feasibility and motivations of a potential ownership change. Analyzing the market share, pricing strategies, and product differentiation of competitors like Remington relative to Ruger provides valuable insight into potential strategic objectives. Furthermore, examining industry trends, such as technological advancements, changes in consumer preferences, or legislative shifts, provides crucial context for interpreting the competitive landscape. Ultimately, a comprehensive understanding of competitive dynamics provides a more rigorous framework to assess the likelihood and implications of a potential ownership transition between Ruger and Remington.

8. Industry Consolidation

Industry consolidation, the merging or acquisition of companies within a specific sector, is a significant factor in evaluating potential ownership relationships like the hypothetical ownership of Remington by Ruger. Understanding the trends and motivations behind consolidation provides critical context for analyzing the current and future competitive landscape of the firearms industry, and assists in assessing the likelihood and implications of such a change.

- Motivations for Consolidation

Companies often consolidate for various strategic reasons, including increased market share, economies of scale, reduced competition, diversification of product lines, and enhanced profitability. In the firearms industry, a consolidation, like a potential takeover of Remington by Ruger, might aim to reduce overlapping resources, enhance production efficiencies, or achieve a greater market share by combining their respective strengths and distribution networks. Understanding the specific objectives behind a potential consolidation is crucial in determining if the resulting effect on the market aligns with the goals of either company. Also, the potential consolidation might be driven by a desire to streamline operations or to take advantage of economies of scale in production, distribution, or research and development.

- Historical Precedents

Examining historical precedents of consolidation in the firearms industry, or similar industries, provides valuable context. Identifying past mergers or acquisitions and analyzing their outcomespositive or negativeallows for informed predictions about a potential future change. Understanding similar consolidations in the past helps gauge the effectiveness of such moves. Factors such as regulatory environments and consumer reaction must also be taken into consideration. This historical perspective provides a benchmark to assess potential repercussions, including market reactions, regulatory hurdles, and eventual impact on product offerings and pricing.

- Regulatory Considerations

Government regulations play a significant role in consolidation. Regulatory approvals and restrictions can influence the feasibility and the extent of such a merger or acquisition. For example, antitrust concerns might create barriers, making a consolidation of brands like Ruger and Remington difficult or even impossible. Regulatory bodies often assess the potential impact on competition and consumer choice before approving a merger. Analysis must account for the current regulatory environment within the firearms industry and the likelihood that such a move might face regulatory scrutiny or hurdles. Understanding any specific regulations or legal precedents applicable to the firearms industry in specific jurisdictions is critical.

- Impact on Competitive Dynamics

Consolidation impacts the overall competitive dynamics in the firearms market. The loss of a significant competitor through acquisition can shift the balance of power, potentially leading to increased market concentration and decreased consumer choice. Conversely, consolidation can create a stronger, more efficient entity, potentially driving innovation or increasing the availability of certain firearms through greater production and distribution efficiency. Analysis must also consider the possible impact on pricing and the potential impact on the overall availability of certain firearms or ammunition.

In summary, industry consolidation is a complex phenomenon with various implications for the firearms market. Evaluating the potential acquisition of Remington by Ruger requires a comprehensive analysis of the motivations for consolidation, historical precedents, regulatory hurdles, and the resulting impact on competitive dynamics within the industry. This analysis offers a broader context for interpreting the significance of such an ownership shift.

Frequently Asked Questions

This section addresses common inquiries regarding the ownership relationship between Ruger and Remington, offering concise and factual responses to clarify potential misconceptions.

Question 1: Does Ruger currently own Remington?

Answer: Public records and available information do not indicate that Ruger owns Remington. No definitive acquisition or merger has been publicly announced or documented.

Question 2: Has there been any documented activity suggesting a potential acquisition of Remington by Ruger?

Answer: While no formal acquisition has occurred, analyzing financial reports, press releases, and industry trends can reveal potential indicators of strategic interest. However, these analyses should not be interpreted as definitive proof of an impending or completed acquisition.

Question 3: What are the potential motivations for such an acquisition if it were to occur?

Answer: Potential motivations for a merger or acquisition between the two companies could include consolidating market share, achieving economies of scale in production, expanding into new market segments, or reducing competition. However, such motivations are speculative without concrete evidence of a transaction.

Question 4: What are the potential effects of a potential acquisition on the firearms industry?

Answer: A merger or acquisition could lead to changes in pricing, product lines, market availability, and competition levels. Such effects remain uncertain without evidence of the acquisition.

Question 5: What other factors influence the competitive landscape of the firearms industry?

Answer: Factors beyond the ownership relationship, including market demand, technological advancements, regulatory changes, and shifts in consumer preferences, influence the competitive dynamics within the industry. These factors may have a greater impact on market conditions than any single acquisition.

Question 6: How can I stay informed about potential acquisitions or industry changes?

Answer: Following industry news and financial reports from reputable sources and paying attention to announcements from both Ruger and Remington is crucial. Directly contacting the companies for official statements is also advisable.

In summary, while speculation about a potential ownership relationship exists, definitive evidence is lacking. A thorough understanding of industry dynamics, financial reporting, and competitive analysis remains essential for evaluating potential market shifts accurately.

The following section will explore the detailed history and current market position of both companies, providing a more comprehensive overview of their individual roles in the firearms industry.

Tips for Investigating Ruger and Remington Ownership

Investigating the ownership relationship between Ruger and Remington requires a systematic approach, focusing on verifiable information rather than speculation. Effective investigation involves meticulous examination of available data and industry trends.

Tip 1: Analyze Public Records. Official corporate filings, including articles of incorporation, shareholder lists, and merger agreements, are primary sources. These documents provide concrete evidence of ownership changes. Absence of such filings weakens claims of ownership.

Tip 2: Scrutinize Financial Reports. Financial statements, particularly those detailing acquisitions, mergers, or divestitures, offer direct evidence of corporate activity. Look for entries related to significant transactions involving either company. Changes in asset portfolios, debt structures, and ownership percentages can signal ownership shifts.

Tip 3: Review Press Releases and Public Statements. Company press releases and official statements frequently announce major strategic changes, including acquisitions. Examine official statements carefully for any mention of the other company.

Tip 4: Assess Historical Acquisition Activity. Each company's prior acquisition history reveals patterns and motivations. A company known for acquisitions might be more inclined to acquire another. Absence of any prior acquisitions suggests a different approach to corporate strategy.

Tip 5: Analyze Market Share Trends. Examine market share data for both companies. A significant change in market share for either company following a potential acquisition period warrants further investigation. This requires careful consideration of factors other than acquisition itself, like general market trends.

Tip 6: Evaluate Product Lines. Examine if product lines overlap, complement each other, or present direct competition. Companies might acquire competitors to eliminate competition, or complementary businesses for diversification.

Tip 7: Consider Industry Consolidation. The firearm industry, like other sectors, has seen consolidation trends. Investigate whether any observable consolidation efforts align with any reported acquisition. Compare this to similar trends in the wider industry.

Tip 8: Consult Industry Experts and Analysts. Seeking input from industry analysts and legal experts specializing in corporate law or the firearms industry offers valuable perspective. Their knowledge provides a more nuanced understanding of the sector and helps evaluate the validity of potential claims.

By applying these tips methodically, a more accurate and objective evaluation of ownership claims can be achieved. This approach relies on verified evidence rather than speculation, thus reducing the likelihood of misinterpretations or errors in assessment.

Further investigation into each company's specific history, strategies, and financial performance within the relevant time frames is required for a conclusive answer.

Conclusion

The investigation into whether Ruger owns Remington reveals a complex interplay of historical data, financial reports, and market dynamics. Analysis of acquisition records, financial statements, and competitive trends indicates no definitive proof of ownership. While circumstantial evidence might suggest potential strategic interest, concrete documentation of an acquisition is absent. The lack of conclusive proof underlines the importance of verifying ownership through transparent and verifiable legal and financial records.

Ultimately, the absence of definitive ownership information underscores the importance of critically evaluating claims and relying on verifiable data. Future analyses of potential ownership changes within the firearms industry, or in similar sectors, should prioritize a rigorous examination of publicly accessible corporate information to avoid unfounded speculation. Clear and transparent communication by relevant companies is essential for stakeholders, enabling well-informed investment decisions and comprehensive understanding of market dynamics.